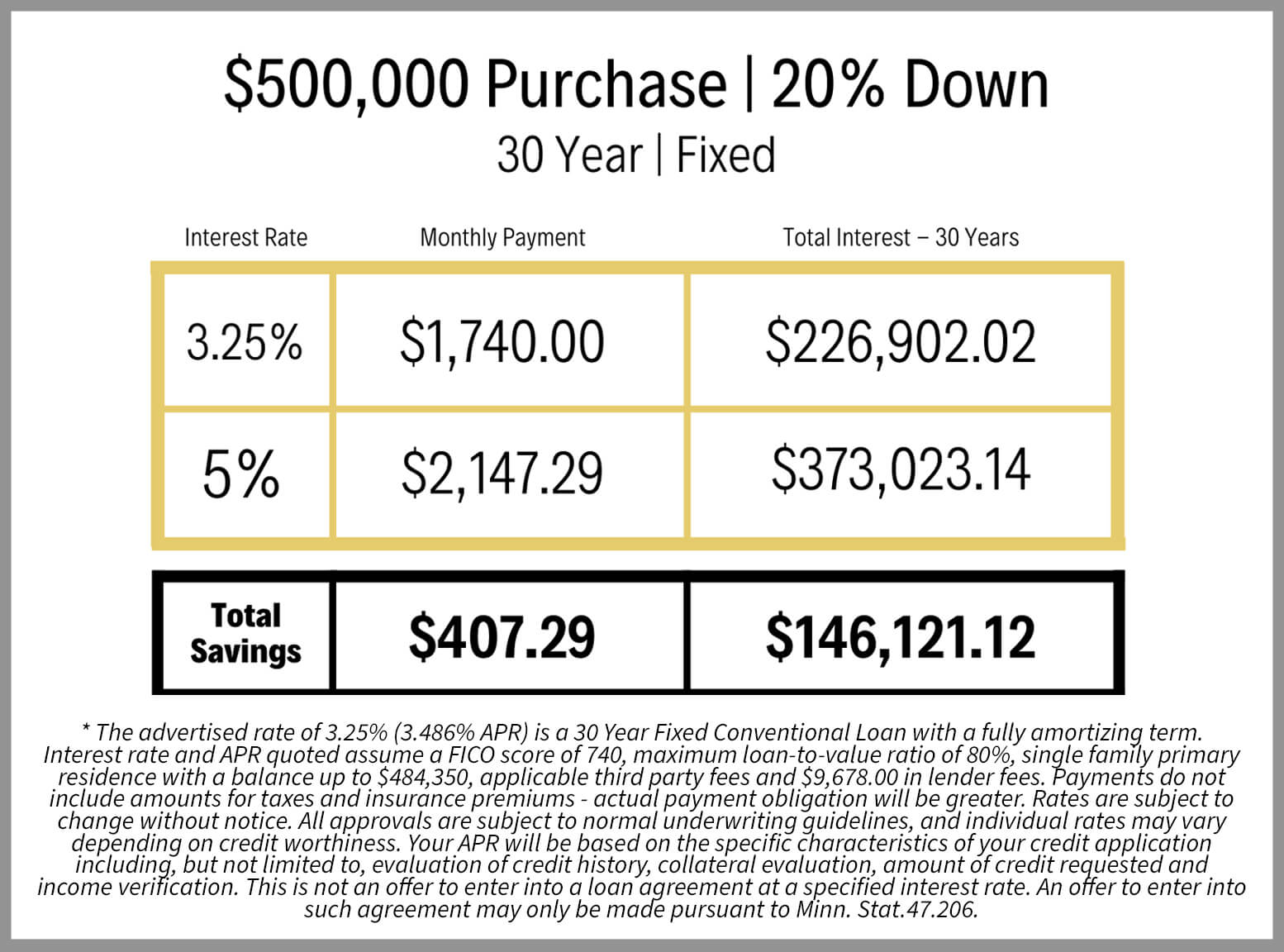

Today’s low-interest-rate environment has made home affordability the best it’s been since early 2018.

Despite the average home price increasing by nearly $13,000 from just over a year ago, the monthly mortgage payment required to buy that same home has actually dropped by 10 percent due to falling interest rates.

The median monthly income that is now required to purchase a home is now 20.6 percent, the smallest payment-to-income ratio in two years. In contrast that ratio was almost 35 percent at the height of the housing boom. This means that a homebuyer could purchase a home costing $48,000 more than they could have bought at the same time last year with the same monthly principal and interest payment. This is a 16 percent increase in buying power.

Talk to your Pratt Homes Sales Consultant to learn more about home affordability.